The growth of artificial intelligence ( AI ) in Asia is boosting the demand for data centres capable of handling the increasing computing power that the technology demands, and this, in turn, offers opportunities to investors willing to help meet this demand.

As well, the high energy consumption of these AI data centres is driving the industry to seek reliable and consistent renewable energy sources.

Globally, an estimated US$1 trillion investment, according to Nvidia CEO Jensen Huang, is needed to upgrade current data centres to handle future AI and cloud computing demand. Of this amount, US$200 billion is expected to be invested in Asia over the next four years, according to Rangu Salgame, the chairman and CEO of Princeton Digital Group ( PDG ), who spoke with The Asset.

PDG is a Singapore-headquartered data centre developer and operator that serves global hyperscalers and enterprises across six key Asian markets – China, Japan, India, Malaysia, Singapore and Indonesia – and has plans to expand into Australia and South Korea.

Data centres have been evolving throughout this century, Salgame offers. “The shift has been from single-floor data centres to purpose-built buildings. Now, we are seeing large-scale campuses serving as data centres.”

In the beginning, data centres were mainly used by e-commerce and internet companies and were typically small-scale, housed in single-floor areas within existing commercial buildings. However, with the emergence 15 years ago of cloud computing, the data centre industry began to construct dedicated data centre buildings. A second major shift occurred two years ago with the rise of AI. To accommodate the technology’s massive power consumption of AI chips, the industry began building campus-style data centres.

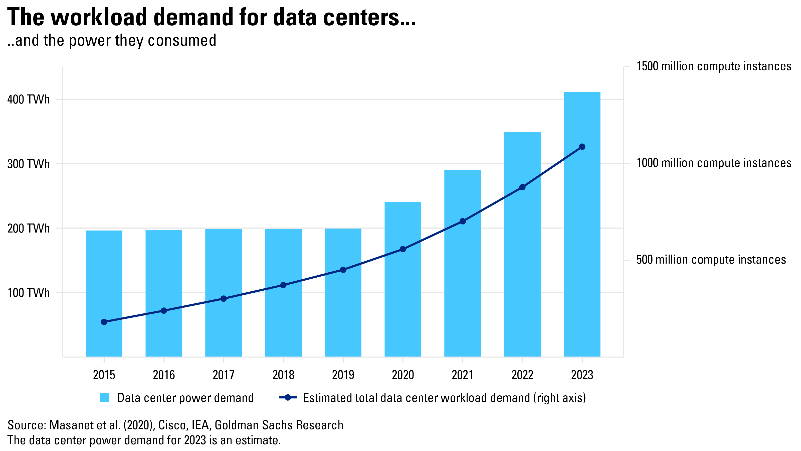

Data centres consume large amounts of energy. On average, a ChatGPT query, according to the International Energy Agency, requires nearly 10 times as much electricity to process as a Google search. Currently, data centres worldwide consume 1% to 2% of global power, but this percentage, according to Goldman Sachs Research, is expected to rise to 3% to 4% by the end of the decade.

And the overall increase in data centre power consumption from AI is estimated to be approximately 200 terawatt-hours per year between 2023 and 2030. By 2028, AI is projected to account for about 19% of data centre power demand.

“Large amounts of power and land are two critical factors in building and operating data centres for hyperscalers,” Salgame points out. “Power is a significant concern in our sector, and it’s crucial to choose the right location to access the appropriate type of energy. There are advantageous locations across Asia where we can develop data centres at this scale.”

Southeast Asia surge

In 2023, the Southeast Asian data centre market attracted US$10.23 billion in investments, with projections reaching US$17.73 billion by 2029, reflecting a compound annual growth rate ( CAGR ) of 9.59%, according to investment bank and advisory firm ARC Group; and the data centre construction market is expected to grow at a CAGR of 11.18%, reaching US$5.29 billion by 2029.

In September 2024, PDG announced that it had acquired necessary land ( 88 acres ) in key markets across Asia, including in Malaysia, Indonesia and India, to expand its power capacity by 500 megawatts ( MW ). This development is part of the company’s larger US$5 billion investment programme focused on building AI-ready data centres across the region and in key computing centres like Mumbai, Chennai, Johor and Jakarta.

Green push

In addition, having access to reliable green energy is becoming increasingly important as data centre providers build these even-larger campuses for AI. In 2023, PDG signed a 25-year renewable power consumption agreement with Tata Power Renewable Energy for its 48MW Mumbai data centre.

In Jakarta, Indonesia, PDG signed a renewable energy contract with Cikarang Listrindo to use the company’s biomass-sourced energy in its Cibitung data centre. The Cibitung centre has a total capacity of 30MW, with 20% initially powered by renewable energy as part of the multi-year contract.

Overall, in 2023, US$6.3 billion of green investments flowed into Southeast Asia, according to a report from Bain & Company, GenZero, Standard Chartered and Temasek, representing a 21% year-on-year increase. While renewable energy remained the region’s primary green investment theme, green data centre projects – supported by efficiency policies in countries like Malaysia and Singapore – drove the largest gains compared with the previous year.

And, as more data centres are committing to green and sustainable development due to the industry’s heavy energy consumption, they are increasingly turning to green and sustainable financing for their projects.

Among them, Singaporean telecommunications giant Singtel’s data centre subsidiaries, DCW and DCKC, secured a S$535 million ( US$408 million ) five-year green loan provided by DBS, OCBC, Standard Chartered Bank and UOB in December 2023.

PDG secured two green loans in 2024 – US$280 million for its 150MW AI-ready JH1 campus in Sedenak Tech Park in Johor, Malaysia, and US$95 million for its SG1 data centre located in central Singapore. As well, the company, Salgame notes, is set to secure its first sustainability-linked loan in the next 12 months.

Since these AI data centres host high-quality hyperscaler clients like Amazon Web Services, Google Cloud and Microsoft Azure, which have signed long-term contracts with data centre providers, these projects present good and relatively safe opportunities for investors.

“Our customers are hyperscalers – major cloud and AI companies,” Salgame shares. “Three things matter most to them. First, they will only do business with companies that have a strong execution track record. The second important factor is access to high-quality, well-capitalized funding because building a data centre requires significant investment. And the third factor is having the right talent.”