Asia saw a dramatic upswing in fixed income funds in 2024, with net inflows surging nearly threefold compared to the previous year, a new report finds.

Equity funds, on the other hand, fell out of favour, plunging from a positive inflow of US$1.9 billion in 2023 to an outflow of US$0.88 billion last year, according to the latest Global Fund Flows from global funds network Calastone. ( All data for 2024 covers the period from January to November. )

.

.

Fixed income gains market dominance

Bond investments were the most significant driver of inflows across Asia in 2024. The region recorded US$26.38 billion of net inflows into fixed income strategies, surpassing the total combined net inflows of the previous five years.

This trend mirrors a global shift towards fixed income, driven by falling interest rates and cautious economic sentiment, the report says.

Inflows into Hong Kong more than tripled to US$11.67 billion, from US$3.8 billion in 2023, while Singapore nearly doubled to US6.49 billion from US$3.01 billion.

Equity markets take a sharp fall

Asia equity funds remained firmly out of favour for the third consecutive year. Driven primarily by local investors shedding assets, the region saw net outflows accelerating to a record US$0.88 billion last year, a stark contrast to net inflows of US$11.75 billion in 2021.

The shift highlights growing investor caution towards regional equities and a broader preference for more predictable yield opportunities, Calastone says.

Steady demand for mixed asset funds

Mixed asset funds have shown resilience in turbulent markets, posting net inflows of US$1.43 billion in 2024. While a significant drop from the record US$11.8 billion seen in 2021, the performance reflects continued investor interest even in challenging market conditions.

The steady inflows in 2023 and 2024, though more modest, highlight a shift towards cautious optimism after the explosive gains of previous years.

As investors seek balanced strategies to navigate uncertainty, mixed asset funds remain a popular choice, offering investors diversified exposure across asset classes, says the report.

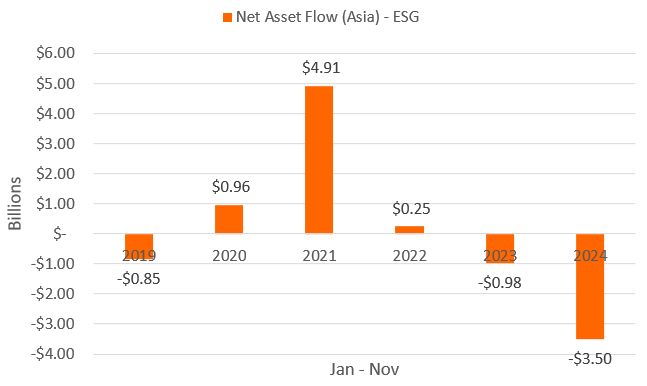

ESG funds see record outflows

The environmental, social and governance ( ESG ) investment landscape in Asia took a sharp turn in 2024, with net outflows hitting a staggering US$3.5 billion – the largest decline on record.

This marks a steep reversal from the US$4.91 billion inflows seen in 2021, highlighting the growing uncertainty in the region's ESG space, Calastone says.

Justin Christopher, head of Asia at Calastone, remarks: “2024’s fund flow data highlights the agility and adaptability of investors across Asia in responding to evolving market conditions. The decisive pivot towards fixed income reflects a strategic response to lower interest rates, while sharp equity fund outflows, coupled with sustained demand for mixed asset funds, underscore the importance of diversification in navigating uncertainty.”

“Meanwhile, record-breaking outflows from ESG strategies point to growing scepticism around sustainable investments, as shifting market dynamics and wavering confidence continue to reshape investor priorities,” Christopher adds.