Australian asset managers saw their real estate assets under management ( AUM ) rise 18% to A$330 billion ( US$214.4 billion ) in 2024, from A$279 billion in the previous year.

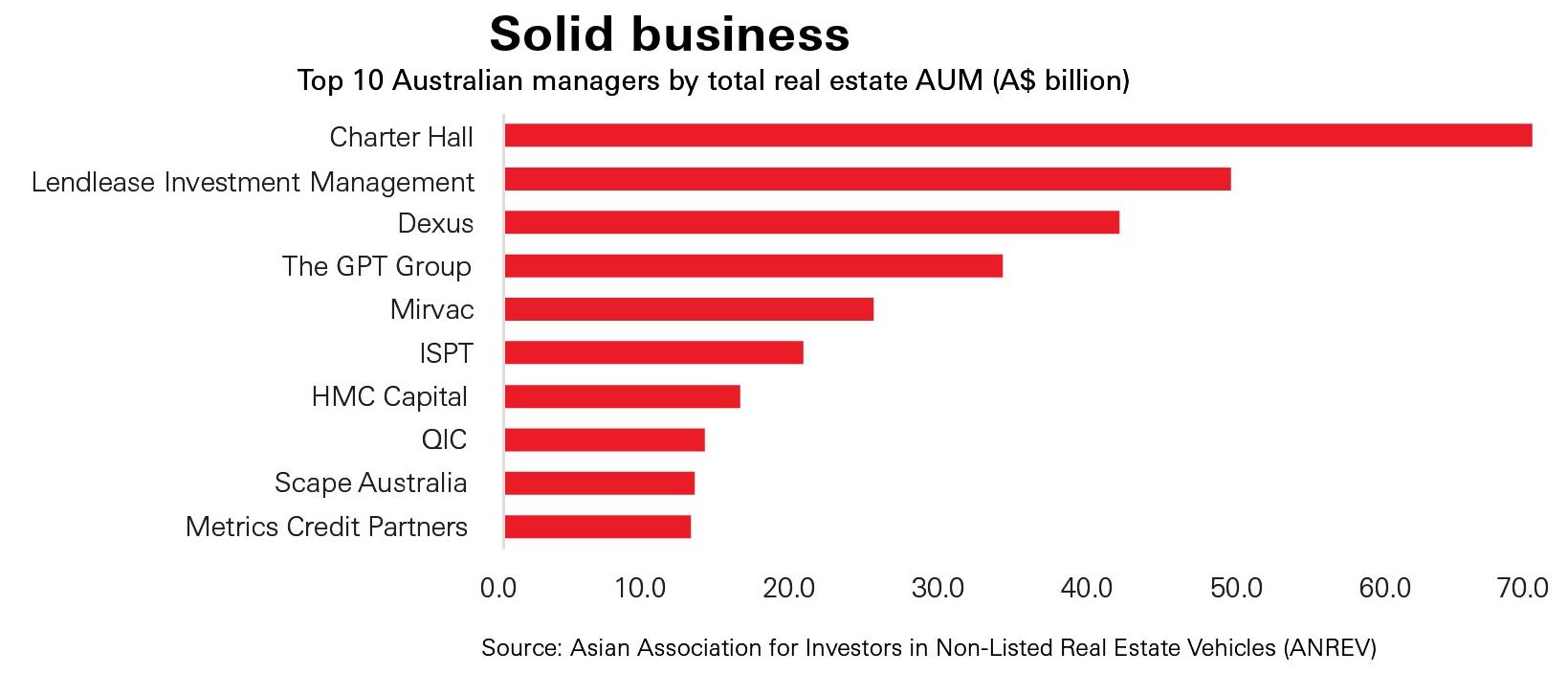

Charter Hall retains its position as Australia's largest real estate fund manager, widening its lead on peers and posting an AUM of A$83 billion in the segment last year, according to the latest fund manager survey by industry associations ANREV, INREV, and NCREIF.

There is a reshuffling in the ranking of the five largest managers, as Lendlease Investment Management climbs to second position with an AUM of A$50 billion, bringing Dexus to third place with A$42 billion. Also in the top five are the GPT Group at A$34 billion and Mirvac at A$25 billion.

When focusing solely on AUM in the Asia-Pacific region, Dexus reported A$42 billion, slightly ahead of Lendlease. The result reflects Lendlease's higher degree of diversification outside of the region among the top three managers.

In the global ranking by Asia-Pacific real estate AUM, in terms of representation from Australian managers, Charter Hall ranks fourth while Dexus is in tenth position. ESR secures the top spot, with A$176 billion allocated to real estate in Asia-Pacific, followed by GLP Capital Partners with A$112 billion and CapitaLand in third with A$96 billion.

"It is encouraging to see such strong growth in Australian managers' AUM in 2024, reflecting renewed investor confidence,” comments ANREV chief executive Charles Haase.

“With asset performance in the Australian market showing signs of recovery, and given Australia's reputation as a mature, transparent, and well-regulated institutional real estate market, we expect continued interest from both domestic and international investors."

The survey covered 114 managers with total real estate AUM of US$3.8 trillion at the end of 2024.