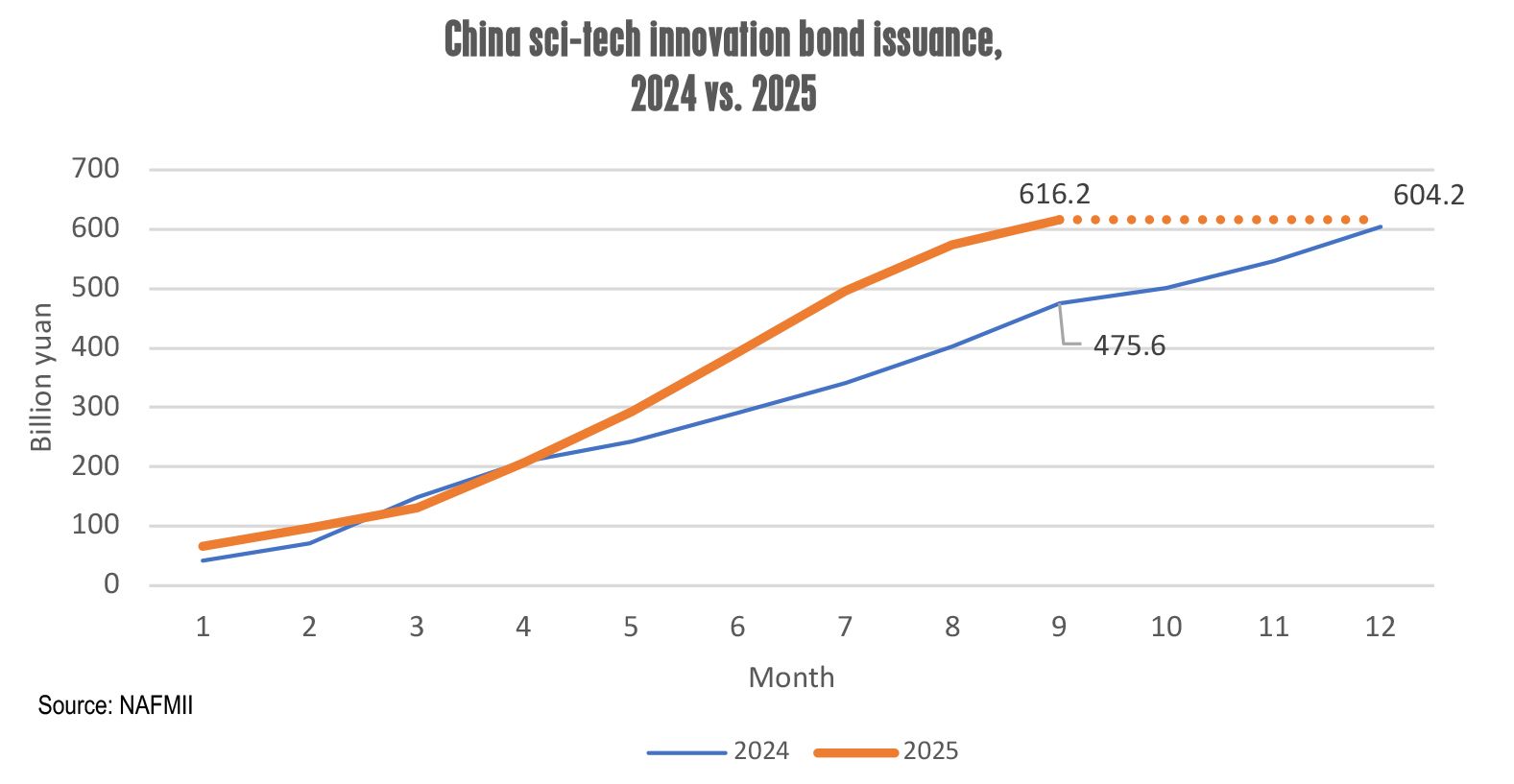

Issuance of sci-tech innovation bonds in China’s interbank market reached 616.2 billion yuan ( US$86.8 billion ) in the first three quarters of 2025, representing a 29.5% increase compared with the same period last year and exceeding the total issuance in 2024, according to data from the National Association of Financial Market Institutional Investors ( NAFMII ).

Sci-tech innovation bonds are debt instruments issued by technology companies, private equity/venture capital ( PE/VC ) firms, and other financial institutions, whose proceeds are intended to fund science and technology-related investment activities such as research and development and manufacturing.

Rising competition

The strong growth in the issuance of sci-tech innovation bonds reflects the huge demand for financing in China’s science and technology sector. It also aligns with one of the key strategic goals outlined at the country’s recently concluded central committee meeting in Beijing – to “substantially improve the nation’s self-reliance in the science and technology area” over the next five years.

The pursuit of self-reliance in science and technology is not a new thing for China, but it has become increasingly relevant amid the rising competition with the United States on artificial intelligence ( AI ), robotics, and other advanced technologies as geopolitical tensions grow.

“Invest in the early-stage companies, invest in the small-scale companies, invest with a long-term view, and invest in hard techs” has emerged as the Chinese government’s investment philosophy, necessitating policy revisions in the capital market to encourage science and technology investments.

Back in 2018, China introduced the STAR market in the Shanghai Stock Exchange to simplify the listing requirements and processes for tech companies.

But for many smaller-scale tech firms that have yet to reach the minimum listing standards, debt financing remains a key channel to raise funds. However, these companies also encounter bottlenecks in debt financing because of their deemed high credit risks.

Alternative channel

Since 2022, policymakers have been leveraging the interbank bond market to facilitate access to capital for early-stage, small-scale, and high-potential tech companies. With this arrangement in place, tech companies can regard the interbank market as an alternative channel to tap the debt capital market in addition to issuing bonds via exchanges.

In May 2025, the People's Bank of China and the China Securities Regulatory Commission jointly issued a series of policy measures to support the issuance of sci-tech innovation bonds, expanding the coverage to include tech companies, PE/VC firms, and financial institutions.

The NAFMII subsequently announced the establishment of a “technology board” in the interbank market, mirroring the STAR board in the equity market, to improve liquidity and lower the financing costs for sci-tech innovation bonds.

Allowing PE/VC firms and financial institutions to issue sci-tech bonds is a major feature of the technology board. The arrangement not only expands the issuer base; it also aligns with the government’s investment philosophy of supporting high-potential tech firms.

Looking ahead, the combination of targeted regulatory support, a technology board in the interbank market, and continued backing from state-aligned funds should steadily expand capital access for these companies.