CapitaLand Investment Limited ( CLI ), a Singapore-listed global real asset manager, has raised about S$150 million ( US$116 million ) at the first close of its CapitaLand India Data Centre Fund ( CIDCF ).

The fund focuses on data centre development opportunities in India’s key data centre corridors. It was anchored by a third-party global institutional investor, with a GP commitment from CLI. CIDCF is targeting a final close of approximately S$300 million.

With the first close, CIDCF will acquire a 20.2% interest in each of three data centres in India from CapitaLand India Trust ( CLINT ) for 7.02 billion rupees ( US$77.6 million ).

CapitaLand's data centre tower in Airoli, Navi Mumbai.

CapitaLand's data centre tower in Airoli, Navi Mumbai.

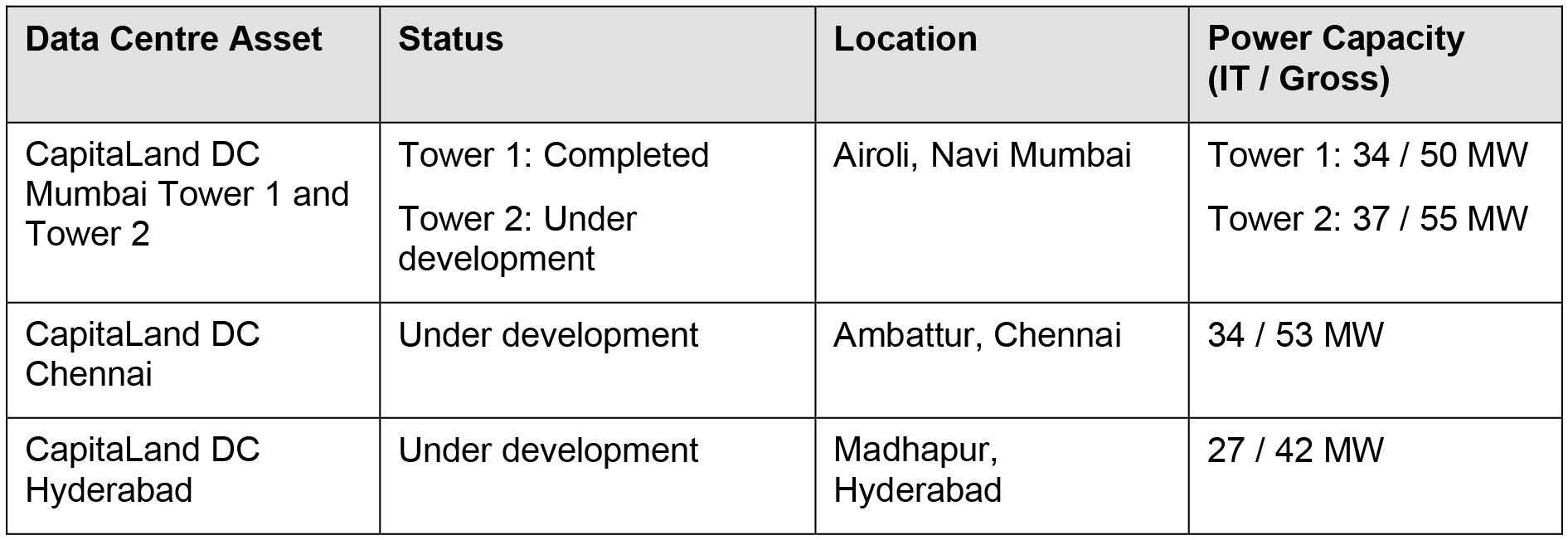

The three data centres will be AI-ready with sustainable design features, and able to meet the demands of hyperscalers and large enterprises in the region. Power has been secured for all three projects, which will have a combined gross capacity of 200 megawatts.

The three data centres are:

Additionally, CIDCF will have the right of first offer on acquiring an interest in CLINT’s fourth data centre in Bangalore.

“The successful first close and investor’s support in CIDCF underscore CLI’s investment and development strategies to shape India's dynamic data centre landscape,” says CLI group chief operating officer Andrew Lim.

“India has emerged as a hotspot for data centre investment, driven by cloud adoption, data localization, and the rapid growth of AI-led workloads. The country’s data centre capacity is expected to double by 2027. With three prime assets currently under development and power secured, CIDCF offers an attractive prospect for private capital to participate in this growth opportunity.”

CLI’s real estate portfolio in India spans business parks, industrial and logistics facilities, data centres, lodging and co-working assets, with funds under management of approximately S$8.4 billion in the country as of November 5.

Currently, CLI manages assets across eight key Indian cities, including Bangalore, Chennai, Hyderabad, Mumbai, Pune, Gurgaon, Kolkata, and Goa. CLI’s India portfolio comprises 38 assets with a total gross floor area of approximately 39 million square feet, including around 27 million square feet of Grade A office space, and logistics assets of over 12 million square feet.